As India’s economy and population continues to grow, its energy needs would continue to grow as well. India’s GDP grew by 8.2% in Q1 2018-2019, and is expected to grow fivefold by 2040. Its population is expected to surpass China’s population by 2022, reaching 1.4 billion and creating an ever-increasing energy demand.

India’s Current Energy Mix

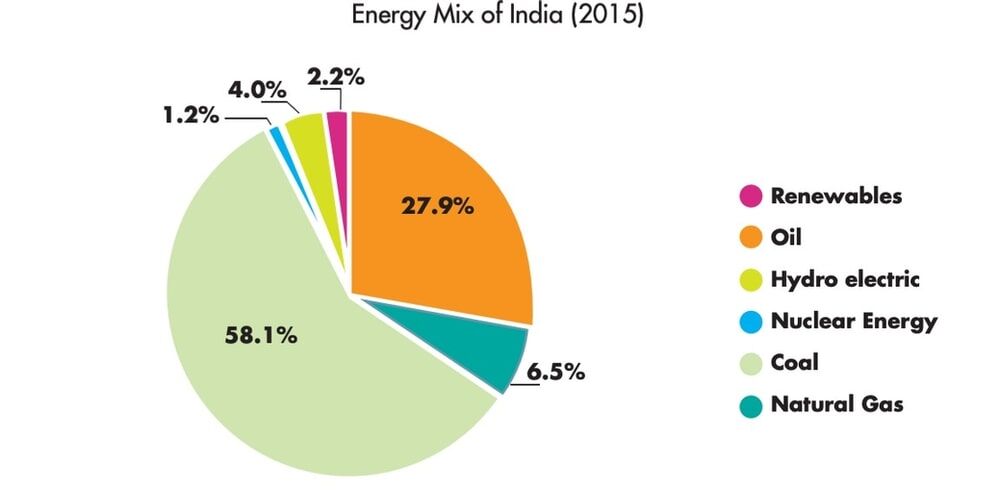

Currently, India imports three-quarters of its energy needs, including 80% of oil. Oil makes up around 30% of India’s energy mix. Natural gas accounted for only 7% in 2017, limiting its role in recent times. However, the government wants to increase it to 15% by 2022, a target considered highly ambitious. The government has taken a number of initiatives such as the Hydrocarbon Exploration and Licensing Policy (HELP). It has also made infrastructural investments to create a natural gas grid. However, the government has yet to create an integrated policy defining the role of natural gas in India’s energy mix.

Source: BP Energy Outlook 2016

Business as Usual Case for Natural Gas

Estimates show that India’s gas consumption is expected to grow to 70 bcm by 2020. However, it is 130 bcm short of reaching the 15% target by 2022. Gas consumption in India is mainly limited to four sectors. Fertilizers hold the largest share (64%), followed by the power industry, city gas, and other industries like petrochemicals and iron and steel. Consumption is primarily driven by factors like price and volatility of gas. While low gas prices are expected to increase demand in the long term, the fertiliser and power industries remain highly price-sensitive. Natural gas in the power sector cannot compete with coal. Coal remains the cheapest fuel unless taxes are levied on its consumption. In the near future, a comprehensive market-based pricing mechanism for natural gas will be essential. This mechanism will promote efficient gas usage and stimulate domestic supply.

The Role of Coal

Coal continues to dominate India’ energy mix, comprising 58% of primary energy consumption. The power sector primarily relies on coal, with gas competing as an alternative fuel. India’s policy on using this polluting fuel highly impacts the growth of coal consumption. The government introduced a tax on coal production in 2014. However, it is not enough to encourage the switch to natural gas. The power sector accounts for half of India’s total CO₂emissions. This has been increasing due to the use of coal. The government mandated supercritical technology for all coal-powered plants. However, India’s position as the world’s fifth-largest coal reserve holder heavily influences the policy. India uses coal to meet one-fourth of its own energy needs.

Going Forward…

Infrastructural development is a critical aspect in optimizing India’s potential as a major gas market. The slow deployment of pipeline infrastructure remains a major challenge. Additionally, the under-utilization of already developed pipelines worsens the issue. Pipeline infrastructure shows significant regional disparities, with Gujarat and Maharashtra possessing 40% of it, while eastern, central, and southern India lack substantial connectivity. This disparity, coupled with limited regasification terminals, adds to a long list of infrastructural woes for India. India’s trunk pipeline target remains underachieved due to lack of financing. However, the government has recently started investing in transmission lines. It has provided a $800 million grant to the Gas Authority of India Limited. A faster execution and completion rate of projects hold the key to the future of India’s gas infrastructure network.

Natural Gas & COP21 Commitments

Commonly overlooked upon, India’s COP 21 commitments should be the biggest driver for the growth of India’s natural gas market. India’s targets are enshrined within its Intended Nationally Determined Contribution (INDC) as part of the UNFCCC COP21 agreement. These aims include reducing the emission intensity of GDP by 33-35% from 2005 levels by 2030. India also aims to achieve 40% of cumulative electric installed capacity from non-fossil fuel sources. Additionally, it seeks to create a carbon sink of 2.5-3 billion tonnes of CO₂ equivalent by 2030. India has one of the most ambitious renewables programs, targeting 175 GW of installed renewable capacity by 2022. Of this, 100 GW will come from solar, 60 GW from wind, and 15 GW from other source. This 175 GW target is a significant determinant for the future of gas in India.

Gas can play a crucial role in balancing the intermittency of renewables and bridging the energy deficit if the targets are not met. Gas, being much cleaner than other fuels, can play a role in reducing CO₂ emissions and meeting India’s INDC targets. A strategic role for gas in the power sector needs to be determined by the government. This will help balance India’s renewables target while complementing its COP21 commitments. At this juncture, India must strongly consider natural gas as the bridging fuel between conventional and renewable sources. It is also crucial to be mindful of natural gas production and extraction strategies. The government has already directed all Industries in Haryana to switch to PNG, wherever it is available.

This year, the government shut down all industries running on coal or diesel in the Delhi NCR region post Diwali, allowing only Industries using PNG as a fuel to run.

The country needs an aligned national policy that recognizes the role of natural gas in India’s energy mix. Government policy, along with the willingness of industrial players, will play a role. Together, they can establish the true golden age of gas in India.